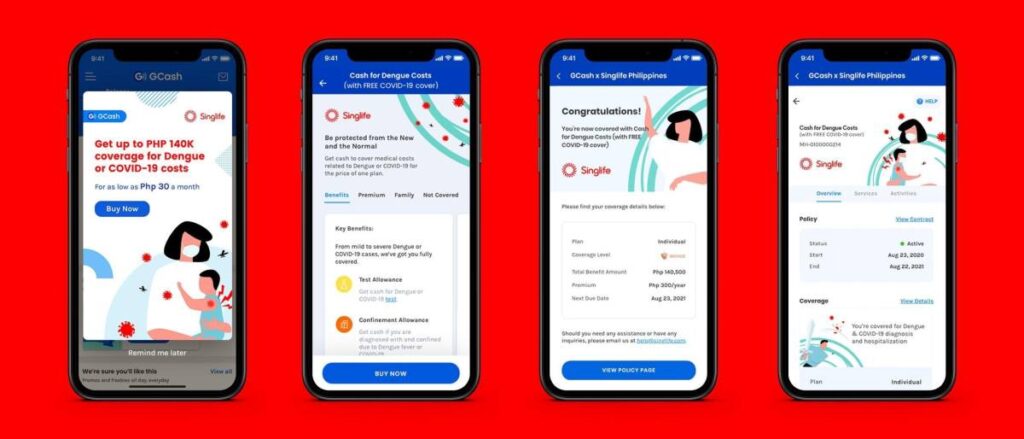

No-fuss protection with Singlife and GCash

by Elton Gagni / September 22, 2020

As the Philippines remains to be one of the hardest hit countries by the pandemic, the insurance industry has seen a significant jump in interest. A survey conducted last May, which involved 300 Filipino insurance customers, revealed that 77 percent intended to purchase additional insurance policies in the next 18 months, which is higher than the regional average of 62 percent.

While market research indicates that 15 percent to 20 percent of Filipinos are attracted by the value of life insurance, there are certain challenges that Filipinos encounter when it comes to insurance, from the discussion itself to consultations, even sustaining their long-term policies.

According to mobile-first insurer Singlife Philippines, there are several hurdles that prevent people from getting insured: Limited access to buy through financial advisors lead to doubt if the customer’s needs are indeed prioritized, and whether the financial advice given is best for them. High premiums come with the expectation that payments will be made in 5 to 20 years’ time to optimize the value of the policy.

The company added that in some cases, some policies hardly survive until the end of the payment period and realize the benefits promised at the moment of purchase. These are affirmed when negative experiences are shared among friends and family and affect decision-making, especially for first-time customers.

To address pain points, Singlife uses digital technology to redesign its products and offer fuss-free protection. “What makes Singlife’s products different is that they are designed to be meaningful: offering basic protection that is easy to purchase, easy to manage, and easy to maintain. You can always ensure that our solutions fit your financial needs, and that you are not bound by long-lasting contracts preventing you from optimizing the value of the product. Singlife empowers you to be in control.” said Singlife Philippines President and CEO Rien Hermans.

Breaking into the Philippine market, Singlife partnered with mobile wallet GCash as it offers simple and flexible products at affordable prices. “This partnership comes at a crucial time when health and financial security are a priority. Leveraging Singlife’s technology and offerings, we have an opportunity to provide more Filipinos with meaningful life insurance products that can effectively protect them and secure their financial well-being,” said GCash President and CEO Martha Sazon.

As the country welcomes the rainy season, Singlife and GCash offers Filipinos a new product; Cash for Dengue Costs, a comprehensive yet affordable protection product that provides a multi-level benefit against medical costs due to mild to severe cases of Dengue – a first of its kind in the market. This product is very flexible with customizable coverage levels, payment terms, and the option to cover an individual or the whole family. As an introductory offer, Singlife will extend the cover by adding a free COVID-19 rider – providing customers protection from both the ongoing pandemic and seasonal worries that they should watch out for themselves and their families.

Proving to be customer-centric and user-friendly, the application process for Cash for Dengue Costs only takes less than five minutes. Customers can even pay, view, manage, and file claims on their Singlife policies directly in the GCash app. This timely offer will be made available to all verified GCash users via the GCash Insurance Marketplace later this year along with other Singlife protection products.

The ongoing pandemic has put an emphasis on the importance of protection. With an easy and affordable offering such as Singlife’s, being insured has definitely become less intimidating and more customer-friendly, especially when it comes to keeping those who matter most safe.

Image Source: @habibdadkhah | unsplash.com