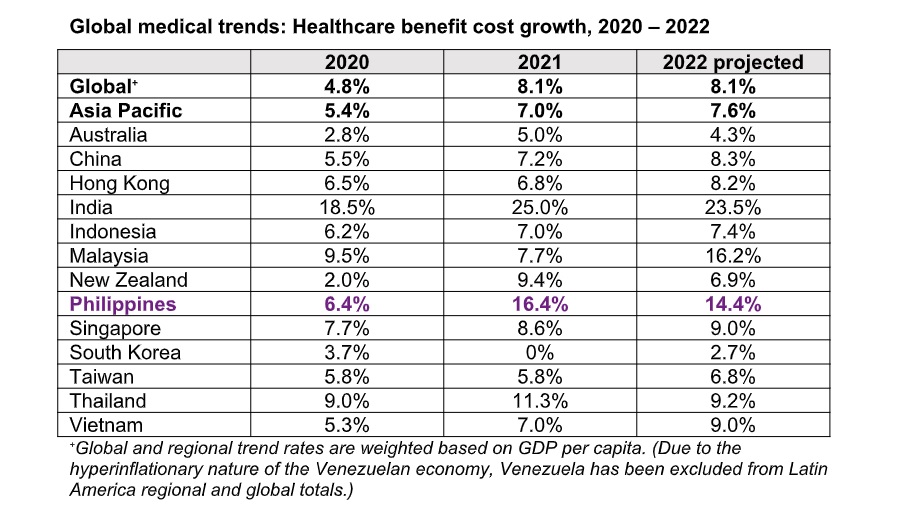

Continuous Care: 14.4% Increase in Philippine healthcare benefit costs expected in 2022

by Madge Resurreccion / January 10, 2022

Almost three years into the pandemic, the Philippines has been adapting to the new normal by giving safer and more convenient options for the people. Documents can be signed through e-signature, shopping for clothes or groceries can be done through mobile applications, and even medical consultations are now online. The pandemic has changed the landscape of the healthcare system, with the rapid development of telehealth services in the Philippines.

Telehealth uses digital information and communication technologies to conveniently assist those in need of medical care or consultation. According to global advisory, broking and solutions company Willis Towers Watson’s (WTW) 2022 Global Medical Trends Survey, employer-sponsored healthcare benefit cost trends are expected to increase by 14.4% on average in the Philippines in 2022. This initially declined in 2020 at 6.4% before rebounding to 16.4% in 2021.

Meanwhile, costs in Asia are expected to rise by 7.6%. The pandemic’s asymmetrical arc, caused by the rise of COVID-19 cases at different times in 2020 and 2021 around the world, then resulted in the volatility in healthcare utilization and costs.

When comparing specific markets in APAC, insurers expect cost trends to be as high as 16.2% in Malaysia and 23.5% in India this year. Meanwhile, in China, Singapore and Vietnam, the increase is projected at 8.3% and 9% respectively. Medical insurers expect healthcare cost trends to accelerate beyond 2022, with six in ten projecting higher or significantly higher costs over the next three years.

WTW International Head of Health and Benefits Cedric Luah emphasized that the pandemic ”produced the biggest impact” to global medical trend variation the industry has seen. “We expect the resultant repercussions and volatility to extend into 2022 and beyond,” he added.

Luah also noted that the pandemic and the changing face of work “has had a significant effect on healthcare needs, delivery of services and the future drivers of medical claims, which in turn will have impact on medical inflation trends.”

The leading driver of medical costs continues to be overuse of care (64%) due to medical professionals recommending too many services or overprescribing. Excess of care by insured members (59%) is the second leading driver. The underuse of preventive services (38%) is also a significant cost driver and increased year-over-year due to, in part, the avoidance of medical care during the pandemic.

According to insurers in APAC, cancer (76%), followed by cardiovascular (62%) and musculoskeletal (48%), are the top three conditions by cost. They also named musculoskeletal, and mental and behavioral disorders as the fastest growing conditions by cost they expect to see over the next 18 months. In response to this, Luah explained that working from home has increased the risk of musculoskeletal injuries while mental health claims are also climbing, according to employers.

In the Philippines, many employers have also focused on providing the mental support employees need as the country continues to fight against the pandemic. WTW Philippines Head of Health and Benefits Susan La Chica said, “The healthcare system has also pivoted to include virtual mental wellbeing support, largely to ensure that employees receive the quality healthcare support they need as they continue to work from home, both virtually and physically. Employers are also reviewing how wellbeing solutions, in general, can be incorporated as a core benefit item, seeking support from insurers or solutions providers like us.”

The survey shows almost four in 10 insurers (35%) identified the addition of new wellbeing services as the biggest change organizations in APAC have made to their medical portfolios in 2021. This is followed by telehealth services (26%), underscored by the potential for cost reductions that virtual healthcare creates. Half of the insurers now offer telehealth across select plans, with 92% offering these services at no additional cost.

La Chica believes the use and evolution of telehealth services will continue post-pandemic to accommodate people in the country. The scope of services is also expected to expand further into other offers, such as mental health services.

As the number of cases surges in the Philippines once again, many are turning to telehealth services. Its development and expansion can significantly help hospitals that are getting overwhelmed by the number of people coming for aid. Now more than ever, telehealth services are needed to assist people in the safety and convenience of their own homes.

Read also

- Food to eat after a series of holiday binge

- Natural home remedies for your cough, colds, and flu

- USAID donates tools for better TB diagnosis, care in PH

Image source: @sushioutlaw | unsplash.com