Embracing innovative solutions in the now digital normal with UnionBank

UnionBank launches banking app for Philippine SMEs

by Nina Tambal / February 8, 2021

With the new year and the now normal in full swing, one can have renewed hope for redefined experiences and innovative solutions. For the Philippine banking industry, matters are stabilizing as it takes the road to recovery.

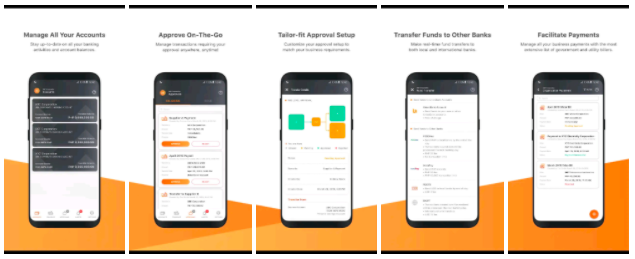

UnionBank of the Philippines (UnionBank) complements this shift as it launched its UnionBank SME banking app available on Google Play and App Store on January 19, 2021.

2020 brought about disruptions across many industries, affecting business activities and leading to a global economic decline. The International Monetary Fund’s October 2020 growth projections showed that the -4.4 percent growth was expected to continue until the end of the year.

But according to a recent McKinsey study, 2021 will be the year of transition. A year that may help people experience the outside world again without fear. A year when leisure travel is on the horizon. And of course, a year that sparks a wave of innovation and launches a generation of entrepreneurs.

So, what better way to witness the early stages of that wave than with an app that empowers small and medium enterprises (SMEs) in the country?

UnionBank’s newest innovation encourages SMEs to embrace digital transformation and as a result, unlock more opportunities for them to pivot, grow, and thrive in the now digital normal. It also underscores the bank’s primary goal of using its digital expertise to extend more financial services to all Filipinos, including the strategically-vital SMEs who comprise about 99 percent of the country’s registered businesses.

“As the country continues to recover, Philippine SMEs need innovative, convenient, and secure banking solutions. Through our platform, we want to empower them to bank the way they want and according to what their business needs,” Jaypee Soliman, UnionBank Vice President for SME Platforms said.

Through the UnionBank SME banking app, any business owner can open their own checking account online with ease and convenience. There is no fuss as the account will be available and ready to use within the same day and there is no need to fill out any forms or visit a branch. The app also helps SMEs manage all their financial operations with just a few clicks.

Furthermore, UnionBank offers other SME banking solutions including SeekCap and UnionBank GlobalLinker. Through SeekCap, business owners can apply for a loan fast and hassle-free. Through UnionBank GlobalLinker, a one-stop-hub digital platform, SMEs are able to manage their inventory and their respective teams, gain more knowledge about the local landscape, as well as expand their network all in one place.

“At the end of the day, we’re all in this together and we want to help all Filipinos be financially inclusive. We are a digital partner that Pinoy SMEs can trust and rely on amid any challenge,” Soliman concluded.

Read also:

- Embracing digital future with Maulik Parekh’s debut novel

- Business Ingenuity in Times of Uncertainty

- Redefining the biz in showbiz

Image source: @glvrdru | Unsplash.com